The purpose of this paper is to discuss the use of the internal rate of return IRR as a principal measure of performance of investments and to highlight some of the weaknesses of the IRR in evaluating investments in this wayThis Education Briefing is an overview of the limitations of the IRR in making capital budgeting decisions. An REFM customer asks three terrific questions about IRR.

Hot Spots The Global City Competitiveness Index Urenio Watch Global City Social Data Chart

10 Which of the following defines IRR.

. NPV equals the Net Present Value. 11 How can the IRR benchmark best be described. The applied benchmark shall be appropriate to the type of IRR calculated.

The combined IRR method calculates a return from a series of IRRs weighted average IRR while the pooled transaction method pools the underlying transactions of the benchmark universe to create a stream of cash flows on which to calculate. Whats a good IRR. 12 What does the internal rate of return IRR measure quizlet.

Even though the internal rate of return IRR metric is popular among business managers it tends to overstate the profitability of a project and can lead to. Using this information the internal rate of return factor can be computed as follows. As an example Howard Marks in a paper titled You Cant Eat IRR lists seven different ways to judge private equity performance.

Note three things about this approach. Beginning in V15 R218 Eagle supports the Private Market Equivalent - IRR PME-IRR calculations. The IRR is equal to the discount rate which leads to a zero Net Present Value NPV of those cash flows.

0 NPV P0 P1 1IRR P2 1IRR2 P3 1IRR3. The discount rate at which a set of cash flows have a positive net present value c. The discount rate at which a set of cash flows have a zero net present value B.

After computing the internal rate of return factor the next step is to locate this discount factor in present value of an annuity of 1 in arrears table. 9 Which of the following defines internal rate of return IRR. Requiredexpected returns on equity are appropriate benchmarks for an equity IRR.

The IRR formula is as follows. Custom-weighted benchmarks can be constructed using either the combined IRR method or pooled transaction method. The Eagle Performance Toolkit can be utilized for IRR calculations for CBFI securities.

The term internal refers to the fact that the calculation excludes external factors such as the risk-free rate inflation the cost of capital or financial risk. How can the IRR benchmark best be described. The return required by the managers of the business.

The method may be applied either ex-post or ex-ante. When the cash flow rises to 200 there will be the first intersection point on the x-axis of the NPV profile when there is -100 cash flows the second intersection will be made. Applied ex-post it measures.

Internal rate of return is a method of calculating an investments rate of return. By definition IRR is the interest rate that makes the summation of the present values of all the cash flows equal zero. The rate required by investors to compensate for a projects level of risk.

Important therefore is the definition of the free cash flows. Rate-based decision statistics are popular because managers like to compare the expected rate of return to which of these. Benchmarks supplied by relevant national authorities are also appropriate.

Local commercial lending rates or WACC are appropriate benchmarks for a project IRR. 3 A blend of a relative and absolute benchmark can also be referred to as a hybrid benchma rk eg an absolute spread over a relative benchmark. Projects with the highest IRRs are considered the most attractive and.

How can the IRR benchmark best be described. IRR is a discount rate. IRR equals the projects internal rate of return.

If you google IRR Private Equity PE you will get pages of results that discuss the pros and cons of using different methods to evaluate the performance of PE funds. Thus a benchmark is a true portfolio and all benchmark performance measures should be computed by first pooling cash flows or valuations. P0 equals the initial investment cash outflow P1 P2 P3 equals the cash flows in periods 1 2 3 etc.

In other words at what IRR is an investment worthwhile. Since the useful life of the machine is. The internal rate of return IRR calculation is based on projected free cash flows.

Applied ex-ante the IRR is an estimate of a future annual rate of return. The internal rate of return IRR can best be described as. The internal rate of return IRR is a metric used in financial analysis to estimate the profitability of potential investments.

Internal rate of return factor 8475 1500 5650. The rate required by investors to compensate for a projects level of risk When does the IRR decision rule. Private-equity firms and oil and gas companies among others commonly use it as a shorthand benchmark to compare the relative attractiveness of diverse investments.

Executives analysts and investors often rely on internal-rate-of-return IRR calculations as one measure of a projects yield. 4 Please see appendix for more information on IRR versus TWR. First because it is a portfolio the benchmark is by definition replicable.

The rate which the business has to pay to raise finance for an investment D. NPV profile intersect at x-axis when NPV is zero and this intersection point indicates the projects internal rate of return IRR The initial outlay is -400. It is illustrated with a number of.

As we teach in our REFM tutorial on internal rate of return we like to describe the IRR as the average annual return on the cash investment up through the point at which the IRR is measuredSo assuming the IRR in question is that measured as of the. The Difference Between MIRR and IRR. Performance analysis fields need to be created to support PME-IRR.

Cambridge Associates 3q15 U S Privateequity Index Selected Benchmark Statistics Valuewalk Com 2016 02 Cambri Private Equity Structured Finance Investing

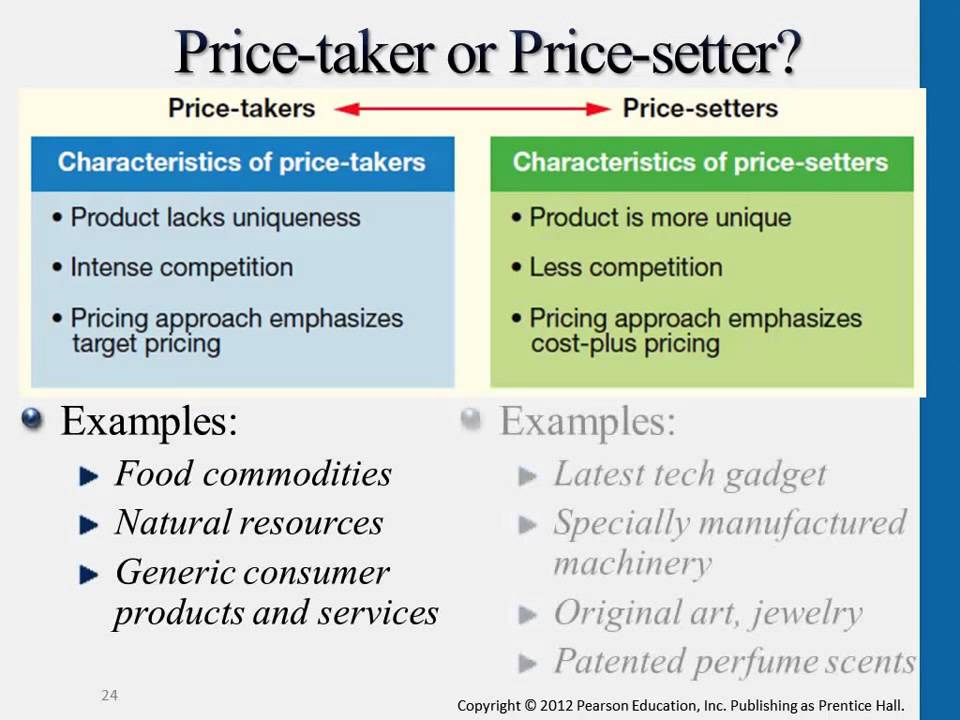

This Video Gave A Good Example Of Price Takers And Price Setters I Found The Examples Given Make It More Relatable Latest Tech Gadgets Relatable Tech Gadgets

0 Comments